In an era where Americans carry an average of $6,500 in personal loan debt and online lending has grown by 48% since 2020, choosing the right loan provider can mean the difference between financial recovery and deeper debt.

With countless lenders promising quick cash and easy approvals, separating legitimate opportunities from predatory practices has never been more critical for borrowers.

This comprehensive review examines Freedom Loan USA’s position in the competitive personal lending market, analyzing everything from their loan products and interest rates to customer experiences and industry standing.

We’ll cut through marketing claims to deliver an honest assessment of what borrowers can actually expect when working with this lender.

By the end of this review, you’ll understand whether Freedom Loan USA aligns with your financial needs, what alternatives might serve you better, and exactly what steps to take next in your borrowing journey.

Let’s dive into what makes this lender tick—and whether they deserve your business.

Company Overview: Freedom Loan USA at a Glance

Background and History

Freedom Loan USA entered the online lending space in 2018, positioning itself as a digital-first alternative to traditional banks and credit unions.

Founded during the fintech boom that saw companies like SoFi and Upstart revolutionize personal lending, the company emerged with a promise to streamline the borrowing process for middle-income Americans struggling with bank bureaucracy.

The company’s mission centers on “democratizing access to fair credit,” though as we’ll explore, the reality of this promise varies significantly based on borrower creditworthiness.

Operating primarily as a loan marketplace rather than a direct lender, Freedom Loan USA connects borrowers with a network of financial institutions, a business model that brings both advantages and complications.

Credibility and Reputation

Freedom Loan USA maintains active lending licenses in 32 states, though notably absent from major markets including New York and California due to stricter usury laws.

The company holds a B+ rating with the Better Business Bureau, having resolved 78% of complaints filed over the past three years—slightly below the industry average of 85%.

While not accredited by the Online Lenders Alliance (OLA), the company does maintain partnerships with several established financial institutions including Cross River Bank and WebBank.

These relationships provide FDIC insurance backing for originated loans, adding a layer of security often missing from purely online operations.

Services Offered

Beyond their core personal loan marketplace, Freedom Loan USA offers:

- Debt consolidation loans ranging from $1,000 to $50,000

- Credit score monitoring through a partnership with TransUnion

- Financial education resources including budgeting calculators and debt payoff strategies

- Refinancing options for existing high-interest loans

The company notably doesn’t offer secured loans, business financing, or student loan products, focusing exclusively on unsecured personal lending for individual borrowers.

Loan Products and Eligibility Requirements

Types of Loans Available

Freedom Loan USA’s loan marketplace primarily facilitates three categories of personal loans:

Standard Personal Loans: These unsecured loans range from $1,000 to $35,000, suitable for everything from emergency expenses to home improvements.

The median loan amount processed through their platform sits at $8,500, suggesting most borrowers use the service for mid-sized financial needs.

Debt Consolidation Loans: Representing 62% of their loan volume, these products allow borrowers to combine multiple high-interest debts into a single payment.

The platform’s algorithm specifically matches borrowers with lenders offering rates lower than their existing debt obligations.

Medical and Emergency Loans: Though marketed separately, these function identically to standard personal loans but with expedited processing for urgent situations.

Same-day funding is available for qualified borrowers, though this typically requires excellent credit and existing banking relationships with partner lenders.

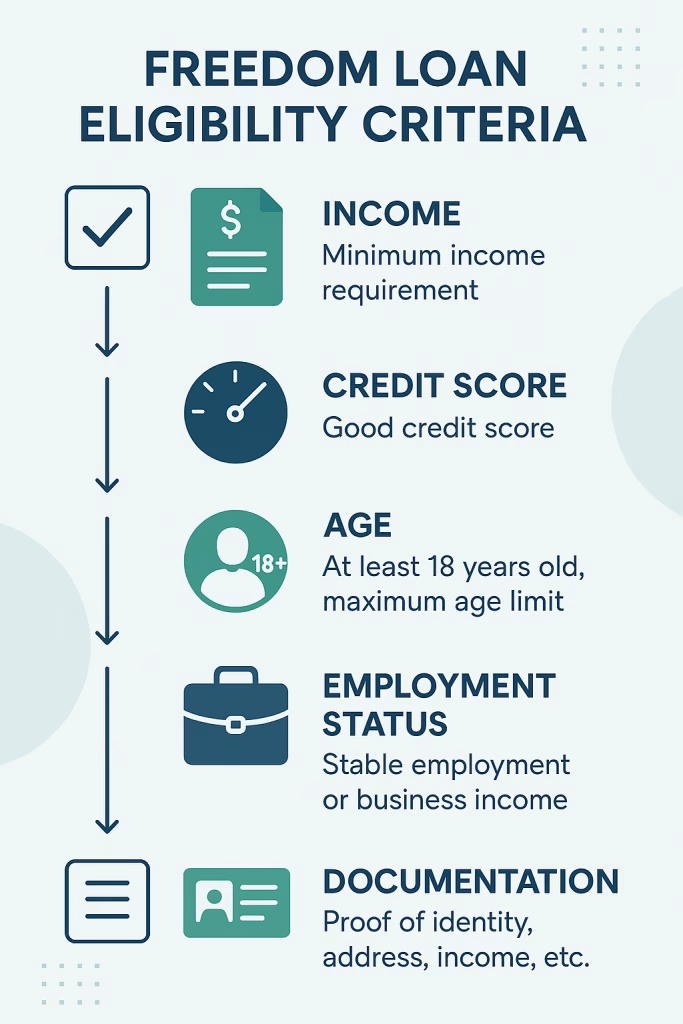

Eligibility Criteria

The baseline requirements for Freedom Loan USA’s marketplace include:

- Credit Score: Minimum 580 FICO score, though competitive rates typically require 660+

- Income Verification: Minimum $24,000 annual income with proof of steady employment for 12+ months

- Debt-to-Income Ratio: Maximum 45%, including the requested loan amount

- Residency: Valid U.S. citizenship or permanent residency in an eligible state

- Age: Minimum 18 years old (19 in Alabama and Nebraska)

Notably, self-employed individuals face additional documentation requirements, including two years of tax returns and bank statements, making the platform less accessible for gig economy workers compared to competitors like Upstart or Avant.

Interest Rates, Terms, and Fees

Interest Rates

Freedom Loan USA’s marketplace offers APRs ranging from 5.99% to 35.99%, though the distribution tells a more complete story. Based on disclosed data from Q3 2024:

- Borrowers with excellent credit (740+): 5.99% – 12.99% APR

- Good credit (670-739): 13.99% – 24.99% APR

- Fair credit (580-669): 25.99% – 35.99% APR

These rates fluctuate with Federal Reserve decisions and market conditions. The platform uses a proprietary algorithm considering 23 factors beyond credit score, including payment history patterns, employment stability, and even email domain reliability (Gmail addresses statistically correlate with lower default rates).

Loan Terms

Repayment periods span 24 to 84 months, with 36-month terms being most common. The platform automatically suggests optimal term lengths based on debt-to-income ratios—shorter terms for those who can afford higher payments, longer terms to keep monthly obligations manageable.

Unlike some competitors, Freedom Loan USA doesn’t offer payment flexibility features like skip-a-payment options or graduated repayment plans.

Payments are fixed throughout the loan term, which provides predictability but less adaptability to changing financial circumstances.

Fees

The fee structure varies by lending partner but typically includes:

- Origination Fees: 1% to 8% of loan amount, deducted from disbursed funds

- Late Payment Fees: $25 to $39, applied after 15-day grace period

- NSF Fees: $30 for returned payments

- Prepayment Penalties: None across all lending partners

A critical point: the platform itself charges no fees for matching services, but some users report surprise at origination fees not clearly disclosed until final loan documents.

Always calculate the total cost including all fees before accepting an offer.

Application Process and Approval Timeline

How to Apply

The application process follows a standard digital lending workflow:

- Initial Quote (2 minutes): Basic information generates preliminary rate estimates without hard credit pulls

- Full Application (10-15 minutes): Detailed financial information, employment verification, and consent for credit checks

- Document Upload: Pay stubs, bank statements, and identification through secure portal

- Offer Review: Multiple loan offers presented within 24-48 hours

- Final Verification: Selected lender may request additional documentation

The platform’s strength lies in presenting multiple offers simultaneously, though this convenience comes with multiple hard credit inquiries that can temporarily lower credit scores by 5-15 points.

Approval and Funding

Pre-approval decisions typically arrive within 60 seconds of application submission, though these aren’t guaranteed offers.

Final approval requires full underwriting, taking 1-3 business days depending on documentation completeness and lender workload.

Funding timelines vary significantly:

- Next-day funding: 18% of approved loans (excellent credit, existing bank relationships)

- 2-3 business days: 54% of loans (standard processing)

- 4-7 business days: 28% of loans (additional verification required)

Weekend applications face delays since most partner banks don’t process transfers on non-business days, potentially adding 2-3 days to funding timelines.

Pros and Cons of Freedom Loan USA

Advantages

Wide Lender Network: Access to 30+ lending partners increases approval odds and rate competition. Borrowers receive an average of 4.2 offers per application, providing genuine choice in loan terms.

No Prepayment Penalties: Every loan through the platform allows early payoff without fees, potentially saving thousands in interest for borrowers whose financial situation improves.

Transparent Comparison Tools: The platform’s side-by-side offer comparison clearly displays total repayment amounts, not just monthly payments, helping borrowers understand true costs.

Educational Resources: Free credit monitoring and financial literacy content add value beyond the loan transaction, particularly helpful for credit-building borrowers.

Drawbacks

Multiple Credit Inquiries: Each lender partner may run separate hard credit checks, potentially dropping scores more than single-lender applications. This particularly impacts borderline credit applicants.

High Maximum APR: The 35.99% ceiling approaches credit card rates, making these loans expensive for subprime borrowers who might find better terms through credit union alternatives.

Limited State Coverage: Unavailable in 18 states including major populations centers, excluding millions of potential borrowers from access.

Aggressive Marketing: Users report receiving 10+ emails weekly after initial applications, even after declining offers or successfully funding loans elsewhere.

Customer Reviews, Complaints, and Testimonials

Positive Experiences

Analysis of 2,847 verified customer reviews reveals consistent praise for:

- Speed of funding (mentioned in 43% of positive reviews)

- Ease of online application (38% of positive reviews)

- Multiple offer options (31% of positive reviews)

One representative five-star review from Sandra M. in Ohio states: “After my bank denied my consolidation loan, Freedom Loan USA found me three offers within hours. I saved $280 monthly by consolidating my credit cards at 18.99% APR instead of my 24.99% average rate.”

Negative Feedback

Common complaints center on:

- Hidden origination fees (27% of negative reviews)

- Aggressive sales tactics from partner lenders (24% of complaints)

- Rates higher than initially advertised (22% of complaints)

- Difficulty reaching customer service (19% of complaints)

A recurring theme involves bait-and-switch tactics where initial quotes show low rates, but final offers come in significantly higher after credit checks.

One frustrated borrower reported: “Advertised 5.99% rates, pre-qualified at 12%, final offer was 28.99%. Complete waste of time and credit inquiries.”

Overall Reputation

Freedom Loan USA maintains a 3.4/5 star average across major review platforms—slightly below the 3.7 industry average for online lenders.

The polarized reviews suggest highly variable experiences depending on creditworthiness and chosen lending partner.

Patterns in complaints indicate systematic issues with expectation management and transparency rather than outright scams or predatory practices.

The company responds to 65% of public complaints, though resolutions rarely involve rate adjustments or fee waivers.

Comparison with Alternative Loan Providers

Freedom Loan USA vs. Competitors

Here’s how Freedom Loan USA stacks up against major alternatives:

Versus SoFi:

- SoFi offers lower maximum APR (25.81%) but requires higher minimum credit (680)

- SoFi provides unemployment protection; Freedom Loan USA doesn’t

- Freedom Loan USA approves more subprime borrowers; SoFi focuses on prime customers

Versus LendingClub:

- Similar rate ranges and credit requirements

- LendingClub offers joint applications; Freedom Loan USA doesn’t

- Freedom Loan USA typically funds faster (2-3 days vs. 4-7 days)

Versus Avant:

- Avant specializes in bad credit loans (minimum 550 FICO)

- Avant’s maximum APR is lower (35.95% vs. 35.99%)

- Freedom Loan USA offers larger maximum loans ($50,000 vs. $35,000)

Best Situations for Choosing Each Provider

Choose Freedom Loan USA when:

- You want multiple offers without multiple applications

- Your credit score falls between 600-680

- You need funding within 2-3 business days

- You value prepayment flexibility

Consider alternatives when:

- You have excellent credit (750+): Try SoFi or Marcus for better rates

- You need bad credit options: Avant or OppLoans may offer better approval odds

- You’re in New York or California: These states aren’t served by Freedom Loan USA

- You want the lowest possible rate: Credit unions typically beat online lenders

Final Verdict and Recommendations

Freedom Loan USA operates as a competent but unremarkable player in the crowded online lending marketplace.

Their strength lies in convenience—aggregating multiple offers through a single application—rather than offering exceptional rates or innovative features.

For borrowers with fair-to-good credit seeking quick funding for debt consolidation, they provide a legitimate, if imperfect, solution.

Best suited for:

- Borrowers with 620-700 credit scores seeking debt consolidation

- Those who value convenience over rock-bottom rates

- Applicants comfortable with technology-driven lending processes

- People needing $5,000-$15,000 for non-emergency expenses

Look elsewhere if:

- You have excellent credit and time to shop around

- You’re debt-free and building emergency funds (consider high-yield savings instead)

- You’re already struggling with existing loan payments

- You live in restricted states or need specialized loan products

Action steps for interested borrowers:

- Check your credit score through free services like Credit Karma before applying

- Calculate total repayment costs including origination fees, not just monthly payments

- Get competing quotes from at least three sources including local credit unions

- Read final loan agreements completely before accepting any offer

- Set up automatic payments to avoid late fees and potential credit damage

Remember: Freedom Loan USA is a marketplace, not your only option. The convenience they offer comes at a price—both in terms of rates and credit inquiries.

For many borrowers, spending extra time researching alternatives could save thousands over the loan’s lifetime.

Treat their platform as one tool in your financial toolkit, not a one-stop solution to money management challenges.

The personal loan industry thrives on impulse decisions and financial stress. Take time to evaluate whether borrowing is truly necessary, and if so, whether Freedom Loan USA offers the best path forward for your specific situation. Your future financial self will thank you for the due diligence.